In the intricate world of international trade, understanding Incoterms DDP, short for Delivered Duty Paid, becomes indispensable for businesses aiming to navigate the complexities of shipping and logistics efficiently. This term signifies a high level of responsibility on the seller’s part, as it encompasses the delivery of goods to a named destination, including all costs and risks, as well as the payment of import duties. The significance of grasping the nuances of Incoterms DDP cannot be overstated, as it directly impacts the financial and operational facets of international transactions. Familiarity with terms like DDP shipping terms, and what does ddp mean in shipping, not only aids in making informed choices but also ensures compliance with global trade regulations.

This article intends to elucidate the meaning of incoterms DDP, outlining the roles and responsibilities it entails for both sellers and buyers within the realm of international commerce. By delving into the intricacies of seller’s and buyer’s responsibilities under DDP, and comparing Incoterms DDP with other Incoterms rules such as Incoterms dap vs ddp, incoterms cpt vs ddp, Incoterms DDP vs exw, and Incoterms ddp vs cif, readers will gain a comprehensive understanding of how DDP can influence transactional dynamics and decision-making processes. The comparison aims to provide a balanced view, highlighting the benefits and drawbacks of DDP for both parties, facilitating a better-informed approach towards choosing the most suitable Incoterms rule for specific trade agreements.

What Is Delivered Duty Paid (Incoterms DDP)?

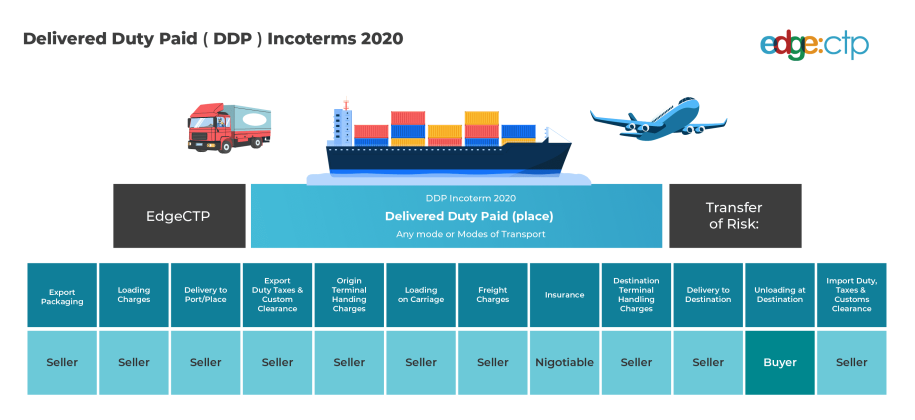

Delivered Duty Paid (DDP) represents one of the most comprehensive shipping terms available under the International Chamber of Commerce (ICC) Incoterms. This arrangement places the maximum responsibility on the seller, who must manage all the logistics from the goods’ origin to the buyer’s destination. This includes arranging transportation, covering all shipping costs, handling export and import duties, and ensuring insurance is in place for the goods until they reach the buyer’s location.

Under DDP, the seller is also responsible for clearing the goods for export, which means they handle all the bureaucratic hurdles involved in getting the goods out of the selling country and into the buying country. This includes paying any taxes and import duties required by the destination country. The risk and the title of the goods transfer from the seller to the buyer only when the goods are made available to the buyer, ready for unloading from the arriving means of transport at the named destination.

DDP is often chosen for its convenience to the buyer, as it minimizes their liability and involvement in the shipping process. The buyer does not need to worry about the intricacies of transportation, customs clearance, or unexpected costs, as these are all the seller’s responsibilities. However, this convenience for the buyer translates into higher risks and costs for the seller, who must ensure that everything goes smoothly across different jurisdictions, which can be challenging and costly.

This term can be applied across various modes of transport, making it a versatile option for global trade. However, sellers need to be aware of the potential complexities in some countries where local customs procedures may be intricate and best handled by someone with local knowledge.

Seller’s Responsibilities Under DDP

Transportation and Shipping Costs

Under the Delivered Duty Paid (DDP) Incoterms, the seller bears the full responsibility for arranging and paying for all transportation costs. This includes the pre-carriage, main carriage, and delivery to the agreed-upon destination. They must ensure the goods are transported through a reliable carrier, managing costs and logistics from the point of origin to the final destination. The seller’s obligation extends to covering any loading charges and ensuring that the goods are delivered on time as specified in the sales contract.

Customs Clearance and Import Duties

The seller is also accountable for managing all customs clearance processes, which involve handling import duties, taxes, and VAT applicable in the buyer’s country. This includes obtaining the necessary export licenses, fulfilling customs formalities, and ensuring all import requirements are met. The seller must pay for all government inspections and provide proof of delivery. In scenarios where customs clearance is complex, the seller’s familiarity with local procedures can be crucial for a smooth process.

Risk and Liability

Responsibility for the goods under DDP terms remains with the seller until they are safely unloaded at the destination. This means the seller assumes all risks of loss or damage during transit. If goods are damaged or lost, the seller is liable for the costs incurred. The seller must ensure that the goods are adequately insured until the point of delivery to mitigate potential risks associated with transportation and handling in different jurisdictions.

Buyer’s Responsibilities Under DDP

Under the Delivered Duty Paid (DDP) Incoterms, the buyer’s responsibilities are relatively minimal compared to the extensive obligations of the seller. However, there are critical aspects that the buyer must manage effectively to ensure a smooth transaction.

Receipt and Unloading of Goods

Once the goods reach the named destination, usually the buyer’s place of business, the buyer is responsible for receiving and unloading the goods from the transport vehicle. This includes handling any unloading fees, which are particularly important to consider when goods are shipped to fulfilment warehouses. The buyer should be prepared for these costs and understand the logistics involved in the unloading process to avoid delays and additional expenses.

Cost and Risk Considerations

While the seller bears the majority of the costs and risks associated with transporting the goods under DDP, the buyer must be vigilant about the potential costs that could arise beyond the point of delivery. Buyers must understand that while DDP covers shipping costs, import and export duties, and taxes, any additional fees incurred after the delivery of goods falls on them. This understanding is vital, especially in scenarios where errors in customs clearance or shipping might occur. In such cases, the buyer may need to interact directly with sellers and local agents to resolve issues, which can be complicated by different time zones and lead to further delays.

The buyer should also be aware that opting for DDP often results in higher overall costs because the seller will likely incorporate all potential expenses into the sales price to mitigate their risk. This means the buyer is usually paying a premium for the convenience and reduced liability offered by the DDP term.

Benefits and Drawbacks of DDP for Buyers and Sellers

Advantages for Buyers

Under the Delivered Duty Paid (DDP) Incoterms, buyers experience significantly reduced risks and responsibilities. They are not liable for delivery costs, taxes, or unexpected charges during the shipping and delivery process. Known costs at the time of purchase eliminate the risk of hidden fees, providing a clear financial picture from the outset. Additionally, buyers benefit from not having to manage the shipping process, including customs clearance and payment of related charges, which are handled by the seller. This simplifies the buyer’s role to merely receiving and unloading the goods upon arrival.

Disadvantages for Sellers

Sellers, on the other hand, face heightened responsibilities and risks under DDP. They are required to manage the entire shipping process, including payment of all transport costs and import duties. This responsibility extends to ensuring customs clearance and dealing with the complexities of international logistics. Sellers must also bear the financial burden of any potential shipping errors or delays, which can be costly and affect their profitability. Furthermore, the obligation to handle all aspects of shipping often forces sellers to choose cost-saving measures that may not always align with the best interests of the shipment, potentially leading to delays or damage to the goods.

Comparing DDP with Other Incoterms

DDP vs. DDU

Delivered Duty Paid (DDP) and Delivered Duty Unpaid (DDU) represent contrasting responsibilities in international shipping. Under DDP, the seller is responsible for all costs and risks, including import duties and taxes, ensuring a seamless delivery to the buyer’s premises. This arrangement minimizes surprises for the buyer, as all potential fees are covered by the seller. In contrast, DDU places the onus on the buyer to handle import duties and taxes once the shipment arrives. This can lead to unexpected costs for the buyer, who must also manage customs clearance and final delivery logistics.

DDP vs. DAP

Comparing DDP with Delivered At Place (DAP) highlights distinct differences in responsibility transfer points. With DDP, the seller assumes all transportation risks and costs until the goods are safely delivered to the buyer’s location, including handling all duties and taxes. This provides buyers with a high level of security and convenience, as they are not liable for any part of the shipping process. On the other hand, under DAP, while the seller is responsible for shipping the goods to the agreed destination, the buyer takes over the responsibility for duties, taxes, and unloading the goods. DAP can be more cost-effective for experienced buyers who have a good grasp of the destination country’s customs procedures and wish to have more control over the import process.

Conclusion

Through a comprehensive exploration of the Delivered Duty Paid (DDP) Incoterms, this article has dissected the layered responsibilities it foists upon sellers and the comparably lesser burden it places on buyers, emphasizing the convenience and risk mitigation it provides to the latter. By contrasting DDP with other Incoterms such as DDU and DAP, we have illuminated the varying degrees of responsibility and risk allocation these terms embody, offering insights into the strategic nuances businesses must consider when engaging in international trade. The significance of understanding these Incoterms, especially DDP, resonates through its impact on transactional dynamics, decision-making processes, and the broader implications for global commerce practices.

The discussions herein underscore not just the operational and financial implications of choosing DDP over alternative Incoterms, but also the importance of familiarity with local customs practices, which can vastly influence the successful navigation of international logistics. For businesses venturing into or expanding within the realm of global trade, recognizing the implications of these terms can strategically position them to mitigate risks and optimize operational efficiency. Therefore, while DDP presents a robust framework for managing the complexities of shipping and delivery in cross-border transactions, it also signals the need for continuous learning and adaptation to the evolving landscapes of international trade law and practice.

FAQs

1. What is meant by Delivered Duty Paid (DDP)?

Delivered Duty Paid (DDP) refers to a shipping agreement where the seller is responsible for handling all aspects of transporting the goods until they arrive at a specified destination. This includes all risks and costs associated with the journey.

2. In a DDP arrangement, who is responsible for covering duties and taxes?

Under DDP terms, the seller is responsible for all costs related to shipping, including customs clearance fees, import duties, and VAT. Essentially, the seller handles all expenses necessary to deliver the goods to the buyer.

3. What are the drawbacks of using DDP as an incoterm?

Using DDP can lead to several disadvantages, such as the buyer having no control over the shipping and importation processes. Additionally, the buyer cannot directly track the shipment or intervene if issues arise. There may also be hidden transportation and import costs included in the seller’s markup.

4. Who is responsible for insurance under DDP Incoterms?

While purchasing cargo insurance is not mandatory under DDP terms, most sellers opt to acquire it due to the extensive responsibilities they bear. The seller’s liabilities conclude only after the goods have been successfully delivered, making insurance a prudent choice to mitigate risk.