In the intricate world of international trade, understanding the nuances of shipping terms is crucial for ensuring the smooth transition of goods across borders. Among these, DAP Incoterms stand out as a pivotal component in defining the responsibilities of sellers and buyers for the delivery of goods. Delivered at Place (DAP) simplifies complex shipping agreements into a clear set of guidelines, making it an essential term for businesses and traders to comprehend. This integral understanding helps in mitigating risks and clarifying the obligations of each party involved in the shipment of goods, thus highlighting the importance of DAP in shipping terms.

The article will delve into the definition of DAP Incoterms, elucidating what DAP means in shipping and its critical role in international commerce. It will further explore the seller’s and buyer’s responsibilities under DAP delivery terms, providing a comprehensive overview of the obligations that each party must fulfill. Additionally, the advantages and disadvantages of utilizing DAP terms will be examined, offering insights into when and why DAP might be the most suitable shipping term. The comparison between DAP and other Incoterms, focusing on key differences, will further enhance the understanding of DAP Incoterms 2020 and its application in global trade scenarios. Through this structured analysis, readers will gain a thorough understanding of Delivered at Place (DAP) and its implications in the realm of shipping and international commerce.

Definition of DAP Incoterms

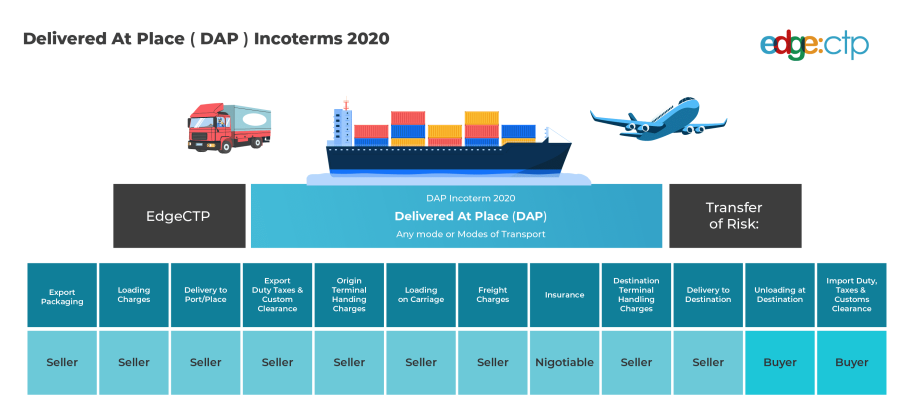

Delivered-at-Place (DAP) is an international trade term that outlines the responsibilities of both the seller and the buyer in the transportation of goods. Under DAP Incoterms, the seller agrees to bear all costs and risks needed to bring the goods to an agreed-upon location, typically the buyer’s premises. This includes responsibilities for packaging, documentation, export approval, loading charges, and ultimately, the delivery of goods.

Overview of Incoterms

Incoterms, or International Commercial Terms, were first established in 1936 by the International Chamber of Commerce (ICC). These terms provide internationally recognized standards to facilitate foreign trade by clarifying the roles, costs, and risks for buyers and sellers in international transactions. DAP, as a part of these terms, specifies that the seller is responsible for all transportation costs and risks until the goods are delivered to the specified location, where the risk then transfers to the buyer.

History and Evolution of DAP

DAP was introduced in the 2010 revision of Incoterms, replacing the former term Delivered Duty Unpaid (DDU). This change aimed to simplify the terms and make them applicable regardless of the transportation method used. The ICC, which has been updating these terms to keep pace with changes in global trade, introduced DAP to create a clearer understanding of the responsibilities in contracts that involve multiple modes of transportation.

Example of DAP

Consider a scenario where a seller in New York agrees to sell goods to a buyer in London under DAP terms. The seller is responsible for all costs and risks involved in transporting the goods from their warehouse in New York to the buyer’s designated location in London. This includes the cost of loading the goods onto a ship in New York and transporting them to London. Upon arrival at the London port, the seller’s responsibility ends, and the buyer assumes responsibility for unloading the goods and paying any applicable duties, taxes, and other charges.

This term is particularly beneficial in transactions where the buyer wishes to control the costs after the goods arrive at the destination, while the seller ensures the goods’ safe arrival to the specified location. Thus, DAP helps in clearly defining the point at which the responsibility and risk shift from the seller to the buyer, facilitating smoother international transactions.

Seller’s Responsibilities under DAP

Packaging and Documentation Requirements

Under DAP Incoterms, the seller is obligated to ensure that the goods are properly packaged for export. This involves securing any documentation necessary for the shipment, which includes commercial invoicing, tallies of goods, and marking related to the export. The seller must also handle all export licenses, permits, and customs clearance, ensuring that the goods comply with international shipping regulations and are ready for transportation.

Costs Incurred by Sellers

The seller bears the full cost of transporting the goods to the designated destination. This encompasses a range of expenses from pre-carriage and main carriage costs to loading charges and freight charges. Sellers are responsible for all costs associated with the delivery to the port, including loading the goods onto the container and any terminal handling charges, both at the origin (OTHC) and destination (DTHC). Additionally, any losses that occur during shipment must be covered by the seller, highlighting their responsibility for the goods until delivery is complete.

Delivery and Transport Duties

The seller’s responsibilities extend to delivering the goods to the named place of destination as agreed upon in the contract of sale. They must manage the entire transportation process, ensuring that the goods arrive safely and are ready for unloading at the destination. While the seller must clear the goods for export, it is important to note that they are not required to clear the goods for import or pay any import duty. The responsibility for unloading the goods and handling import formalities shifts to the buyer once the goods reach the designated destination.

Buyer’s Responsibilities under DAP

Import Duties and Taxes

Under DAP terms, the buyer is responsible for all importation costs associated with the shipment. This includes import duties, taxes, and any customs clearance costs. It is crucial for buyers to understand that these costs are not included in the DAP product price and must be planned for separately. Additionally, in the event that a customs examination is required, the buyer must cover the costs associated with the examination.

Unloading and Transportation

Once the shipment arrives at the designated destination, the buyer assumes the risk and responsibility for unloading the goods from the arriving means of transportation. This responsibility extends to arranging for the cargo to be unloaded at the final destination, which is typically a warehouse or other storage facility. Furthermore, the buyer must manage the onward carriage and delivery of the goods from the port or place of arrival to the final destination.

Associated Costs and Rispects

Beyond the direct costs of duties and unloading, the buyer must also consider additional expenses that may arise during the import process. These can include freight insurance, customs brokerage fees, and any charges incurred due to delays, dunnage, or detention at the port. These additional costs are the buyer’s responsibility and can vary depending on the specifics of the shipment and the local regulations at the destination. Buyers should be prepared for these potential expenses and include them in their overall cost planning for international shipments under DAP terms.

Advantages and Disadvantages of DAP

Pros for Sellers

Sellers benefit from DAP terms primarily due to greater control over transportation costs and the shipping process. By handling the shipment up to the designated destination, sellers can manage transportation expenses more effectively. Additionally, since the responsibility for import clearance falls on the buyer, sellers avoid the complexities and potential risks associated with customs in the destination country. This arrangement can be particularly advantageous when sellers want to maintain oversight of the transportation but prefer not to engage directly with import duty and tax issues.

Pros for Buyers

For buyers, one of the significant advantages of DAP Incoterms is the reduced risk and responsibility during the shipping process. Buyers are not responsible for transportation costs and risks until the goods are delivered to the agreed-upon destination. This setup can aid in better cash flow and inventory management, especially for costly items that require frequent reordering. Moreover, DAP terms allow buyers to only pay for the goods once they are delivered, which can significantly benefit buyers who wish to manage their budget effectively and reduce upfront expenses.

Potential Drawbacks

Despite the advantages, DAP also presents some challenges. For sellers, the risk remains high during the transportation process until the goods reach their destination. Any issues like delays or damage during transit are the seller’s responsibility, potentially leading to financial losses. For buyers, while the initial transportation cost is covered by the seller, they must handle import duties, taxes, and customs clearance. These additional costs can be significant and might lead to delays if not managed properly. Furthermore, buyers have less control over the shipping logistics, which can be a disadvantage if the seller does not efficiently manage the shipment.

In summary, while DAP Incoterms offer clear benefits by delineating responsibilities and costs between sellers and buyers, they also require both parties to carefully manage their roles to avoid potential pitfalls associated with transportation delays, customs clearance, and unexpected costs.

Key Differences between DAP and Other Incoterms

Comparison with DDP

Delivered Duty Paid (DDP) places the utmost responsibility on the seller, including handling all import formalities and associated costs. In contrast, under Delivered at Place (DAP), the seller delivers the goods to a specified location but does not cover duties, taxes, or other charges in the destination country. These are the buyer’s responsibility, along with unloading and final delivery. DDP is more demanding for the seller but offers greater assurance to the buyer, as it includes all costs up to the final destination.

Comparison with CIF

Cost, Insurance, and Freight (CIF) differs from DAP mainly in terms of insurance and cost responsibilities. Under CIF, the seller pays for the cost, insurance, and freight until the goods reach the destination port and clears the goods for export. However, the risk transfers to the buyer once the goods are loaded onto the ship. In DAP, the seller bears all risks and costs until the goods are delivered to the specified location, but insurance is not included and must be negotiated separately.

Comparison with FCA

Free Carrier (FCA) Incoterms requires the seller to deliver goods to a named place and hand them over to a carrier chosen by the buyer. The seller is responsible for all costs until this point, including loading charges and export duties. DAP extends the seller’s responsibilities further, requiring them to manage and pay for transportation all the way to the buyer’s specified destination, not just to a handover point.

Comparison with ExW

Ex Works (EXW) Incoterms places maximum responsibility on the buyer, who must handle all transportation and import formalities starting from the seller’s premises. Under DAP, the seller is responsible for delivering goods to the buyer’s destination and handling all transportation and export formalities, significantly reducing the logistical burden on the buyer compared to EXW.

Comparison with CPT

Carriage Paid To (CPT) Incoterms is similar to DAP in that the seller pays for transporting the goods to a named destination. However, the risk transfers to the buyer much earlier in the process—when the goods are handed over to the first carrier. Under DAP, the seller retains the risk until the goods are delivered to the named place of destination, offering more security to the buyer during transit. This makes DAP more favorable in scenarios where the buyer wants to minimize risk during transportation.

Conclusion

Understanding Delivered at Place (DAP) Incoterms is vital for both sellers and buyers engaged in international trade. Throughout this article, the intricacies of DAP, including the allocation of responsibilities, costs, and risks between the trading parties, have been thoroughly explored. By illustrating how DAP Incoterms streamlines the shipping process and clarifies obligations, this discussion aids stakeholders in making informed decisions that align with their operational strategies and risk management preferences. The comparison with other Incoterms further underscores DAP’s unique position in international logistics and its applicability to a wide range of global trade scenarios.

In the dynamic landscape of international commerce, grasping the nuances of DAP can significantly mitigate potential obstacles, fostering smoother transactional processes and enhancing the efficiency of cross-border exchanges. Stakeholders are encouraged to leverage the insights provided to navigate the complexities of shipping agreements more effectively. Moreover, considering the evolving nature of global trade, continuous engagement with and understanding of Incoterms like DAP is indispensable. As the global economy becomes increasingly interconnected, the relevance of well-informed shipping term choices will only magnify, highlighting the ongoing need for comprehensive awareness and strategic application of Incoterms in international business transactions.

FAQs About: Dap Incoterms

1: What is DAP Incoterms?

DAP stands for “Delivered at Place” and is one of the Incoterms used in international trade. It outlines that the seller is responsible for delivering goods to a specified location and covering all costs and risks associated with transportation up to that point. The buyer is responsible for import duties, taxes, and unloading costs.

2: Can you provide an example of a DAP Incoterm transaction?

In a Delivered-at-Place (DAP) transaction, consider a buyer in London who agrees to a DAP deal with a seller from New York for a shipment of goods. In this scenario, the seller from New York is responsible for all costs and risks involved in transporting the goods from their warehouse to the port in New York and then onwards to London.

3: What does DAP mean and how is it implemented?

DAP stands for Delivered at Place, which is one of the Incoterms used in international trade. It requires the seller to deliver the goods to a location agreed upon by both the seller and the buyer. The seller bears all costs and risks involved in bringing the goods to the specified location, excluding any duties, taxes, and other official fees required for importation as well as the costs of unloading.

4: What does DAP signify in the context of shipping?

In shipping terms, DAP or Delivery at Place means that the seller delivers the goods to a predetermined location, which could be any place, agreed upon between the buyer and the seller. The specific delivery location, such as a terminal, must be clearly identified and agreed upon in the sales contract.

5: In DAP terms, who is responsible for paying the duties?

Under DAP terms, the buyer is responsible for paying the import duties, taxes, customs clearance, and unloading fees. The seller covers all other costs associated with transporting the goods to the agreed delivery location.