In International Trade:

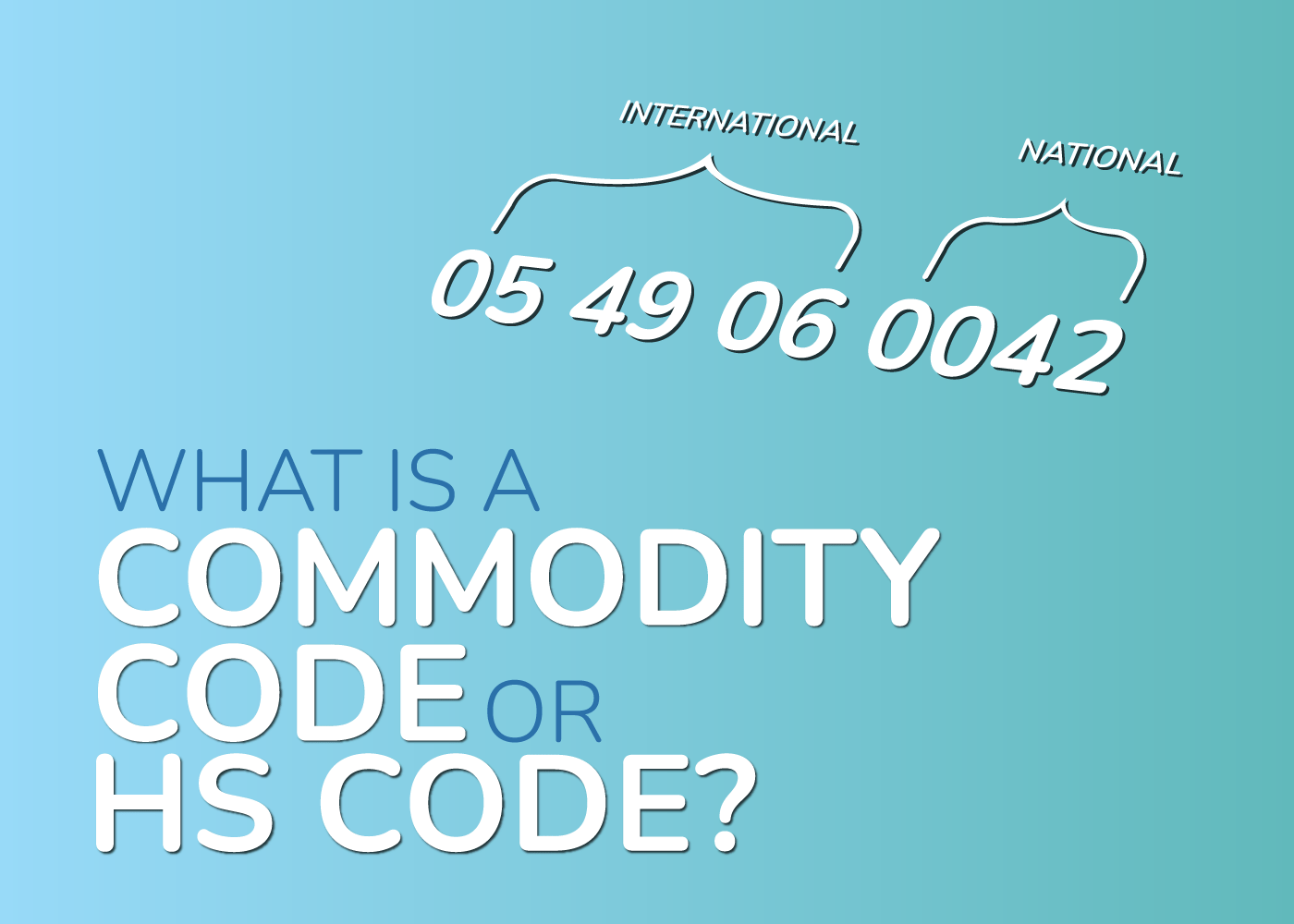

A commodity code is a series of numbers used to identify products that are being imported or exported from the UK. The code is generally ten digits long for imports coming from outside the EU but for exports the first eight digits are sufficient. Once you have the commodity code for your product you will be able to correctly identify the trade requirements involved along with duty rates and any restrictions.

When is a commodity code used?

A commodity code is used whenever goods are being transported to or from the UK and are important for determining how your goods are treated.

Why do I need a commodity code?

If you are involved in international trade it is imperative that you select the correct commodity code for your products. The code will help you to identify things like:

- Duty and tax reliefs

- Customs procedures

- Special regulations such as import/export licences

- VAT or duty owed

- Import/Export document requirements

Remember, it is YOUR responsibility to ensure that the correct commodity code has been used. Failure to do so could mean a costly mistake.

Where can I get a commodity code?

You can find the commodity code for your product by using the online trade tariff provided by gov.uk. Simply use the search bar at the top of the screen or select your product from the selection of classification categories.

Once you have the correct commodity code you can start to look up things like export requirements and duty rates. Our FREE Market Access Database app will tell you everything you need to know at the click of a button. Click on the link below to get started.